1 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Financial Statements (Unaudited) October 29, 2022 and October 30, 2021

2 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Financial Statements (Unaudited) October 29, 2022 and October 30, 2021 Table of Contents Page Consolidated Statements of Comprehensive Income 3 Consolidated Balance Sheets 5 Consolidated Statements of Member’s Equity 6 Consolidated Statements of Cash Flows 7 Notes to the Consolidated Financial Statements 8

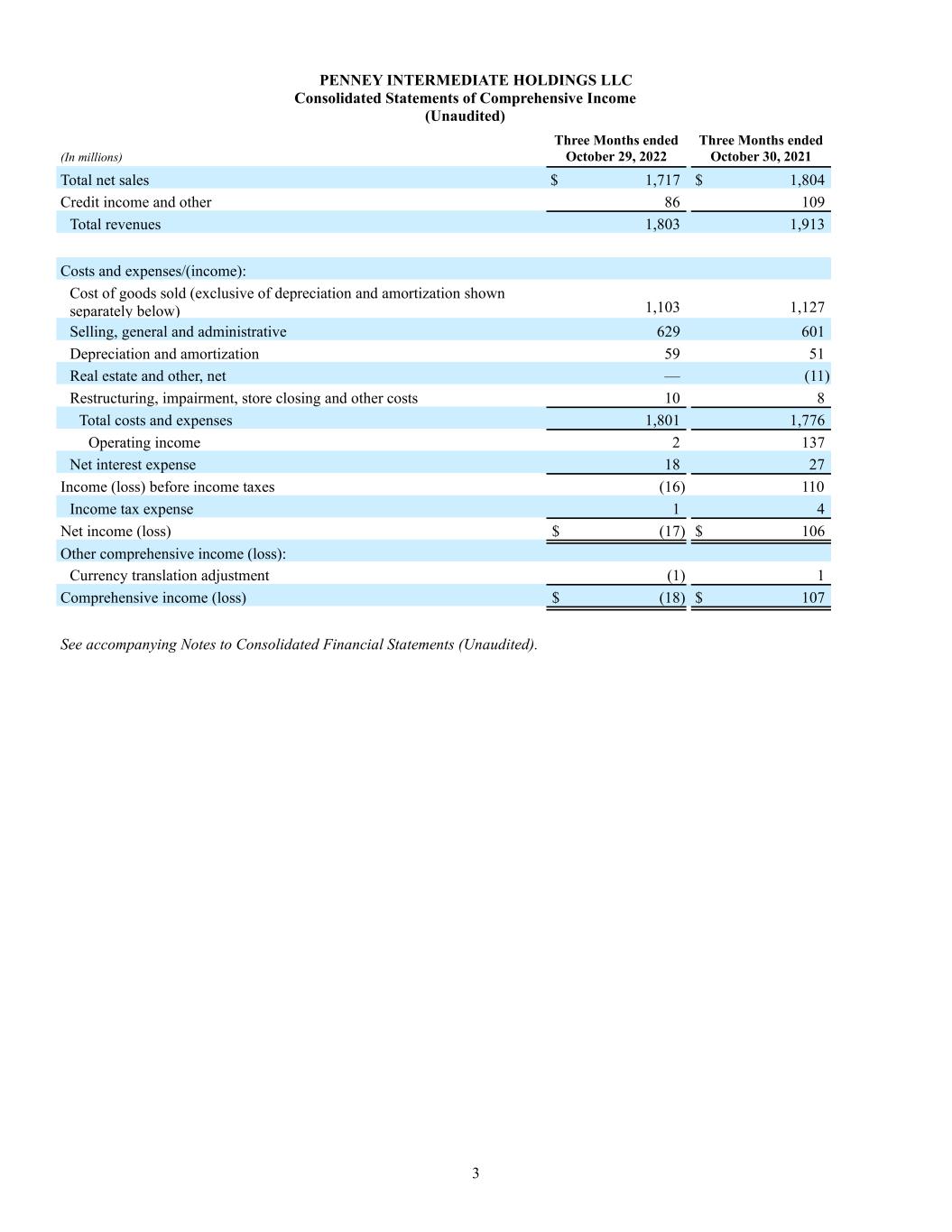

3 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Comprehensive Income (Unaudited) (In millions) Three Months ended October 29, 2022 Three Months ended October 30, 2021 Total net sales $ 1,717 $ 1,804 Credit income and other 86 109 Total revenues 1,803 1,913 Costs and expenses/(income): Cost of goods sold (exclusive of depreciation and amortization shown separately below) 1,103 1,127 Selling, general and administrative 629 601 Depreciation and amortization 59 51 Real estate and other, net — (11) Restructuring, impairment, store closing and other costs 10 8 Total costs and expenses 1,801 1,776 Operating income 2 137 Net interest expense 18 27 Income (loss) before income taxes (16) 110 Income tax expense 1 4 Net income (loss) $ (17) $ 106 Other comprehensive income (loss): Currency translation adjustment (1) 1 Comprehensive income (loss) $ (18) $ 107 See accompanying Notes to Consolidated Financial Statements (Unaudited).

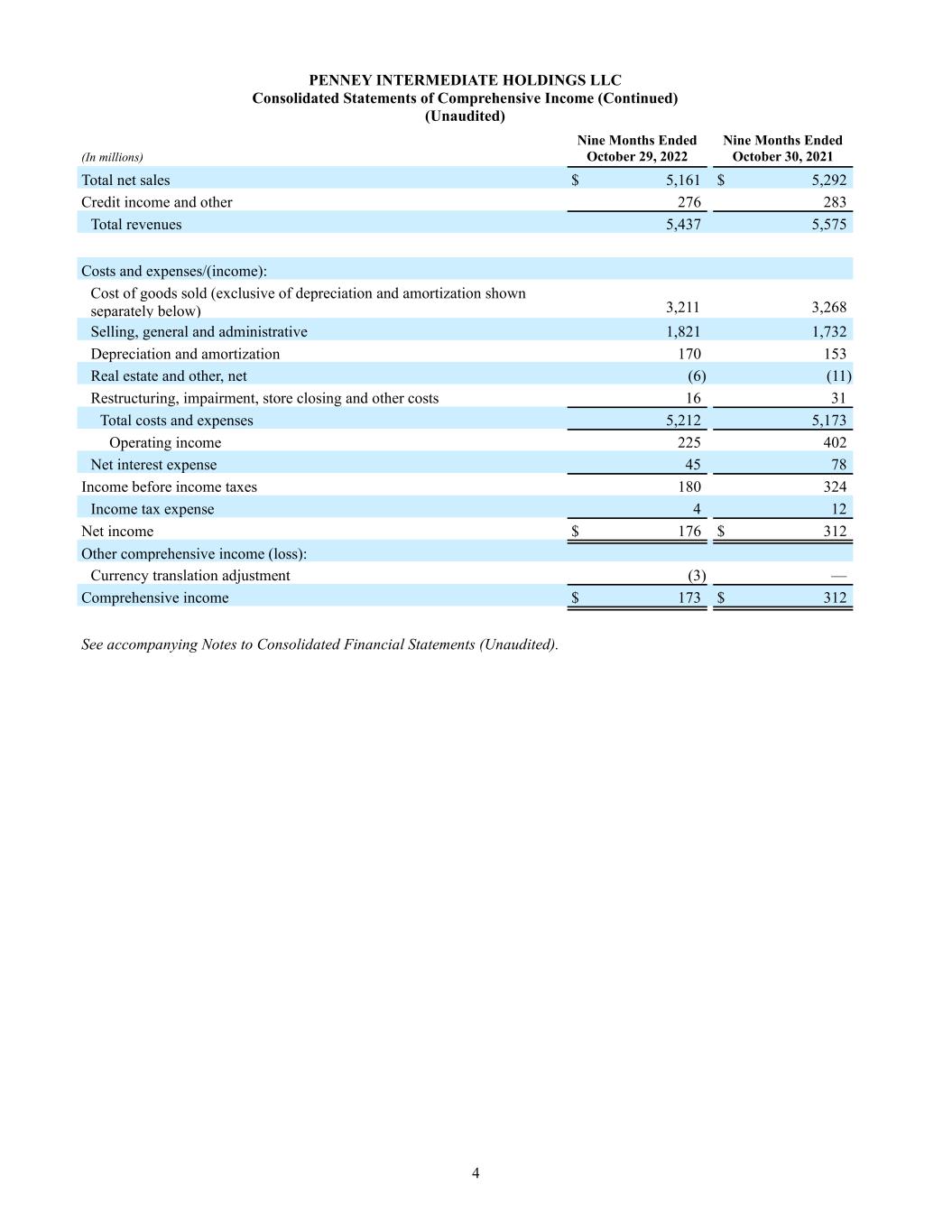

4 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Comprehensive Income (Continued) (Unaudited) (In millions) Nine Months Ended October 29, 2022 Nine Months Ended October 30, 2021 Total net sales $ 5,161 $ 5,292 Credit income and other 276 283 Total revenues 5,437 5,575 Costs and expenses/(income): Cost of goods sold (exclusive of depreciation and amortization shown separately below) 3,211 3,268 Selling, general and administrative 1,821 1,732 Depreciation and amortization 170 153 Real estate and other, net (6) (11) Restructuring, impairment, store closing and other costs 16 31 Total costs and expenses 5,212 5,173 Operating income 225 402 Net interest expense 45 78 Income before income taxes 180 324 Income tax expense 4 12 Net income $ 176 $ 312 Other comprehensive income (loss): Currency translation adjustment (3) — Comprehensive income $ 173 $ 312 See accompanying Notes to Consolidated Financial Statements (Unaudited).

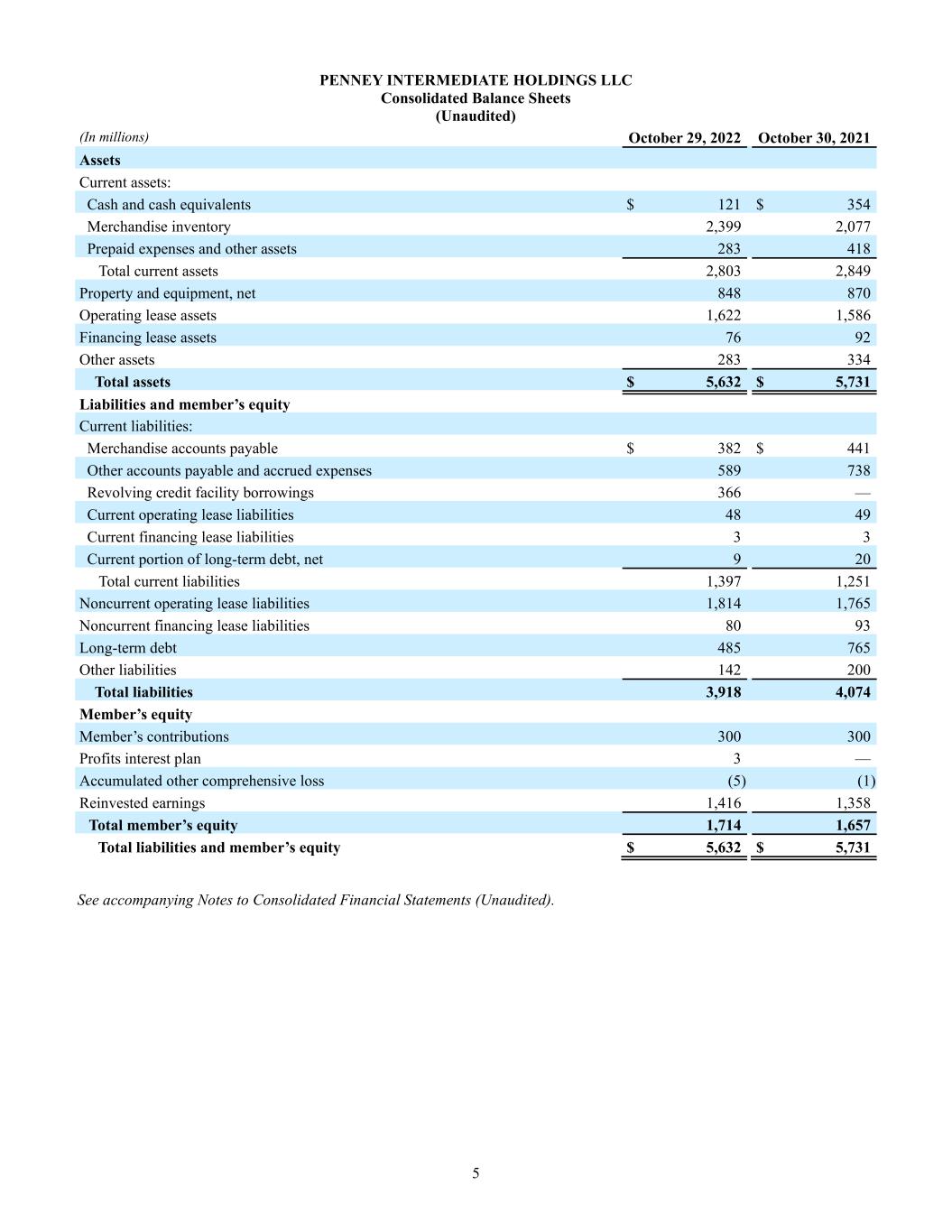

5 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Balance Sheets (Unaudited) (In millions) October 29, 2022 October 30, 2021 Assets Current assets: Cash and cash equivalents $ 121 $ 354 Merchandise inventory 2,399 2,077 Prepaid expenses and other assets 283 418 Total current assets 2,803 2,849 Property and equipment, net 848 870 Operating lease assets 1,622 1,586 Financing lease assets 76 92 Other assets 283 334 Total assets $ 5,632 $ 5,731 Liabilities and member’s equity Current liabilities: Merchandise accounts payable $ 382 $ 441 Other accounts payable and accrued expenses 589 738 Revolving credit facility borrowings 366 — Current operating lease liabilities 48 49 Current financing lease liabilities 3 3 Current portion of long-term debt, net 9 20 Total current liabilities 1,397 1,251 Noncurrent operating lease liabilities 1,814 1,765 Noncurrent financing lease liabilities 80 93 Long-term debt 485 765 Other liabilities 142 200 Total liabilities 3,918 4,074 Member’s equity Member’s contributions 300 300 Profits interest plan 3 — Accumulated other comprehensive loss (5) (1) Reinvested earnings 1,416 1,358 Total member’s equity 1,714 1,657 Total liabilities and member’s equity $ 5,632 $ 5,731 See accompanying Notes to Consolidated Financial Statements (Unaudited).

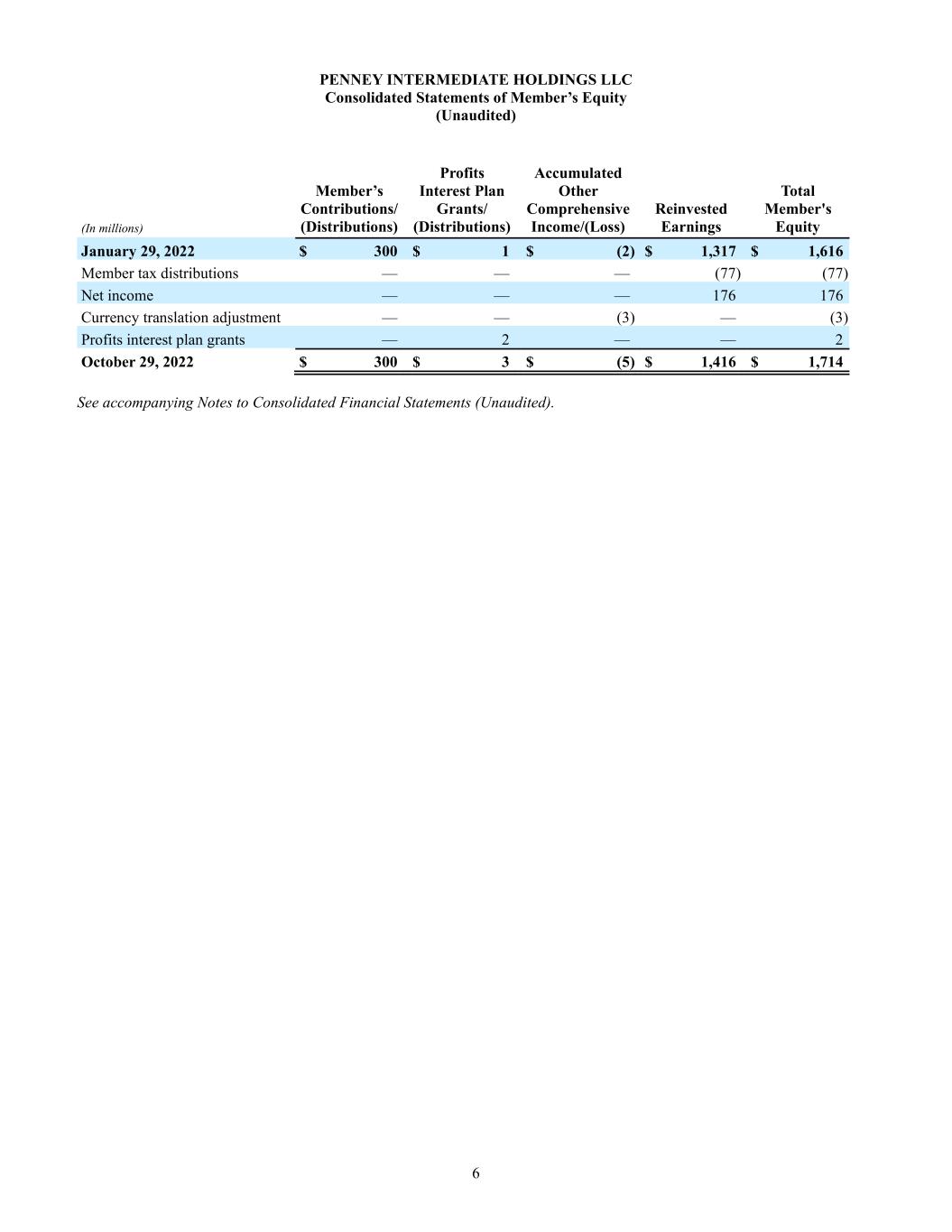

6 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Member’s Equity (Unaudited) (In millions) Member’s Contributions/ (Distributions) Profits Interest Plan Grants/ (Distributions) Accumulated Other Comprehensive Income/(Loss) Reinvested Earnings Total Member's Equity January 29, 2022 $ 300 $ 1 $ (2) $ 1,317 $ 1,616 Member tax distributions — — — (77) (77) Net income — — — 176 176 Currency translation adjustment — — (3) — (3) Profits interest plan grants — 2 — — 2 October 29, 2022 $ 300 $ 3 $ (5) $ 1,416 $ 1,714 See accompanying Notes to Consolidated Financial Statements (Unaudited).

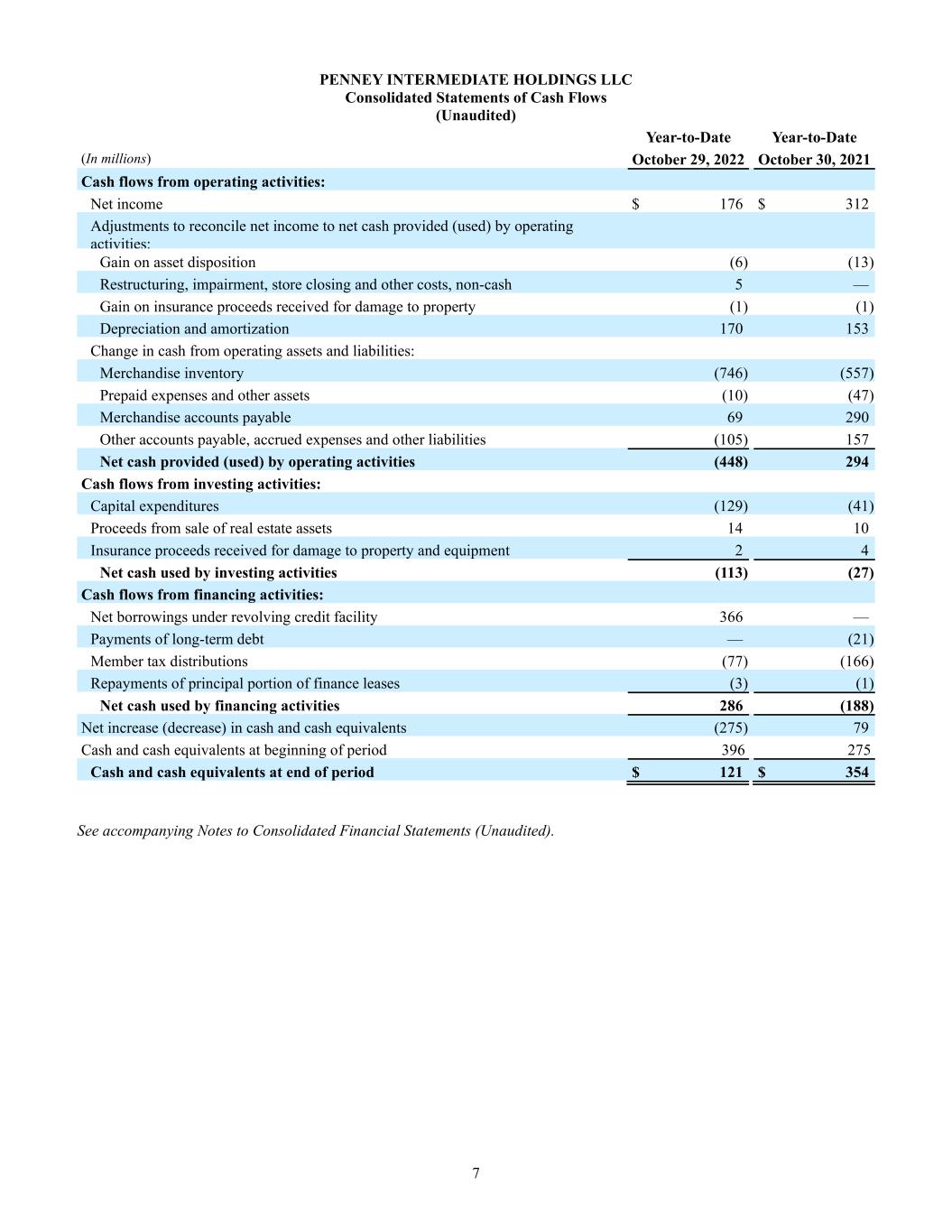

7 PENNEY INTERMEDIATE HOLDINGS LLC Consolidated Statements of Cash Flows (Unaudited) Year-to-Date Year-to-Date (In millions) October 29, 2022 October 30, 2021 Cash flows from operating activities: Net income $ 176 $ 312 Adjustments to reconcile net income to net cash provided (used) by operating activities: Gain on asset disposition (6) (13) Restructuring, impairment, store closing and other costs, non-cash 5 — Gain on insurance proceeds received for damage to property (1) (1) Depreciation and amortization 170 153 Change in cash from operating assets and liabilities: Merchandise inventory (746) (557) Prepaid expenses and other assets (10) (47) Merchandise accounts payable 69 290 Other accounts payable, accrued expenses and other liabilities (105) 157 Net cash provided (used) by operating activities (448) 294 Cash flows from investing activities: Capital expenditures (129) (41) Proceeds from sale of real estate assets 14 10 Insurance proceeds received for damage to property and equipment 2 4 Net cash used by investing activities (113) (27) Cash flows from financing activities: Net borrowings under revolving credit facility 366 — Payments of long-term debt — (21) Member tax distributions (77) (166) Repayments of principal portion of finance leases (3) (1) Net cash used by financing activities 286 (188) Net increase (decrease) in cash and cash equivalents (275) 79 Cash and cash equivalents at beginning of period 396 275 Cash and cash equivalents at end of period $ 121 $ 354 See accompanying Notes to Consolidated Financial Statements (Unaudited).

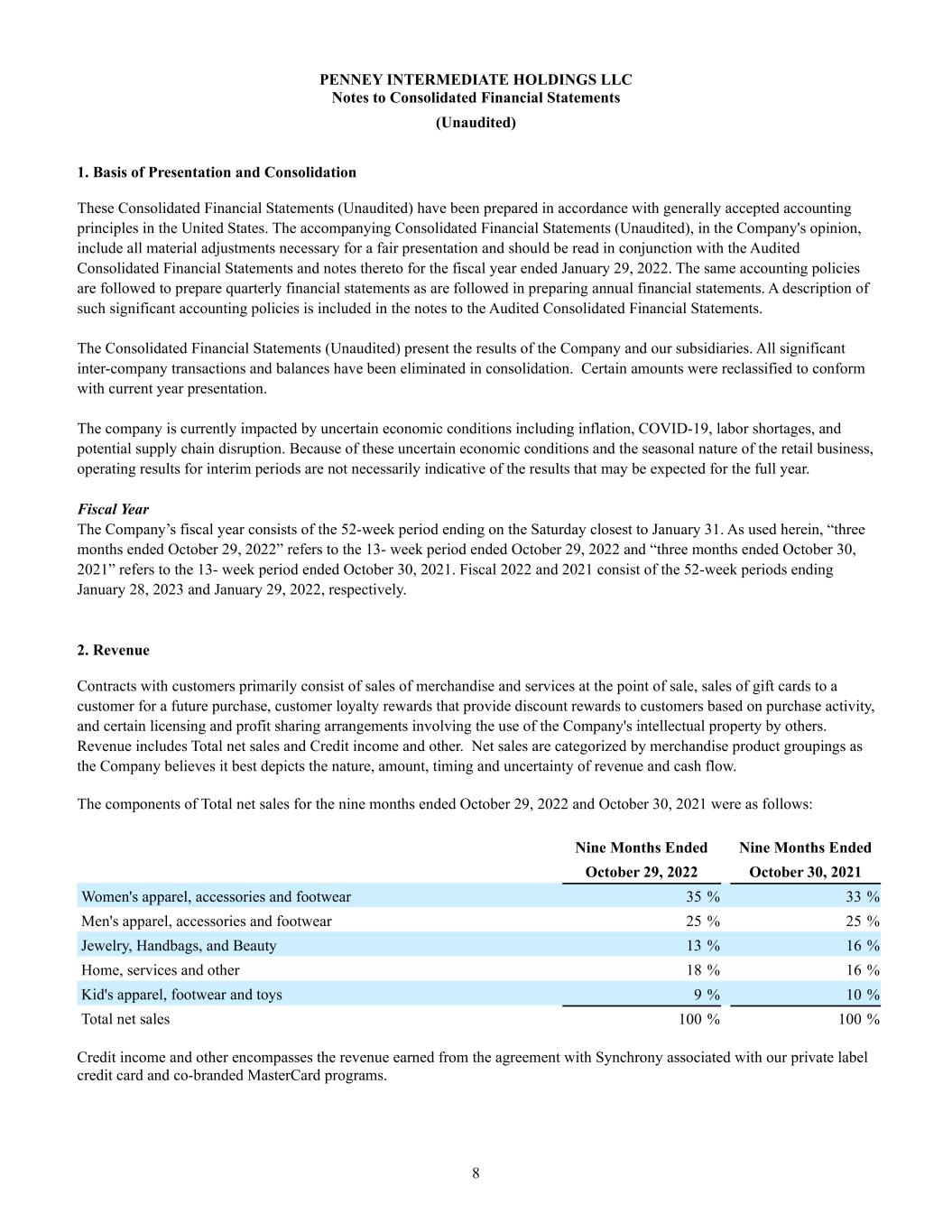

8 PENNEY INTERMEDIATE HOLDINGS LLC Notes to Consolidated Financial Statements (Unaudited) 1. Basis of Presentation and Consolidation These Consolidated Financial Statements (Unaudited) have been prepared in accordance with generally accepted accounting principles in the United States. The accompanying Consolidated Financial Statements (Unaudited), in the Company's opinion, include all material adjustments necessary for a fair presentation and should be read in conjunction with the Audited Consolidated Financial Statements and notes thereto for the fiscal year ended January 29, 2022. The same accounting policies are followed to prepare quarterly financial statements as are followed in preparing annual financial statements. A description of such significant accounting policies is included in the notes to the Audited Consolidated Financial Statements. The Consolidated Financial Statements (Unaudited) present the results of the Company and our subsidiaries. All significant inter-company transactions and balances have been eliminated in consolidation. Certain amounts were reclassified to conform with current year presentation. The company is currently impacted by uncertain economic conditions including inflation, COVID-19, labor shortages, and potential supply chain disruption. Because of these uncertain economic conditions and the seasonal nature of the retail business, operating results for interim periods are not necessarily indicative of the results that may be expected for the full year. Fiscal Year The Company’s fiscal year consists of the 52-week period ending on the Saturday closest to January 31. As used herein, “three months ended October 29, 2022” refers to the 13- week period ended October 29, 2022 and “three months ended October 30, 2021” refers to the 13- week period ended October 30, 2021. Fiscal 2022 and 2021 consist of the 52-week periods ending January 28, 2023 and January 29, 2022, respectively. 2. Revenue Contracts with customers primarily consist of sales of merchandise and services at the point of sale, sales of gift cards to a customer for a future purchase, customer loyalty rewards that provide discount rewards to customers based on purchase activity, and certain licensing and profit sharing arrangements involving the use of the Company's intellectual property by others. Revenue includes Total net sales and Credit income and other. Net sales are categorized by merchandise product groupings as the Company believes it best depicts the nature, amount, timing and uncertainty of revenue and cash flow. The components of Total net sales for the nine months ended October 29, 2022 and October 30, 2021 were as follows: Nine Months Ended Nine Months Ended October 29, 2022 October 30, 2021 Women's apparel, accessories and footwear 35 % 33 % Men's apparel, accessories and footwear 25 % 25 % Jewelry, Handbags, and Beauty 13 % 16 % Home, services and other 18 % 16 % Kid's apparel, footwear and toys 9 % 10 % Total net sales 100 % 100 % Credit income and other encompasses the revenue earned from the agreement with Synchrony associated with our private label credit card and co-branded MasterCard programs.

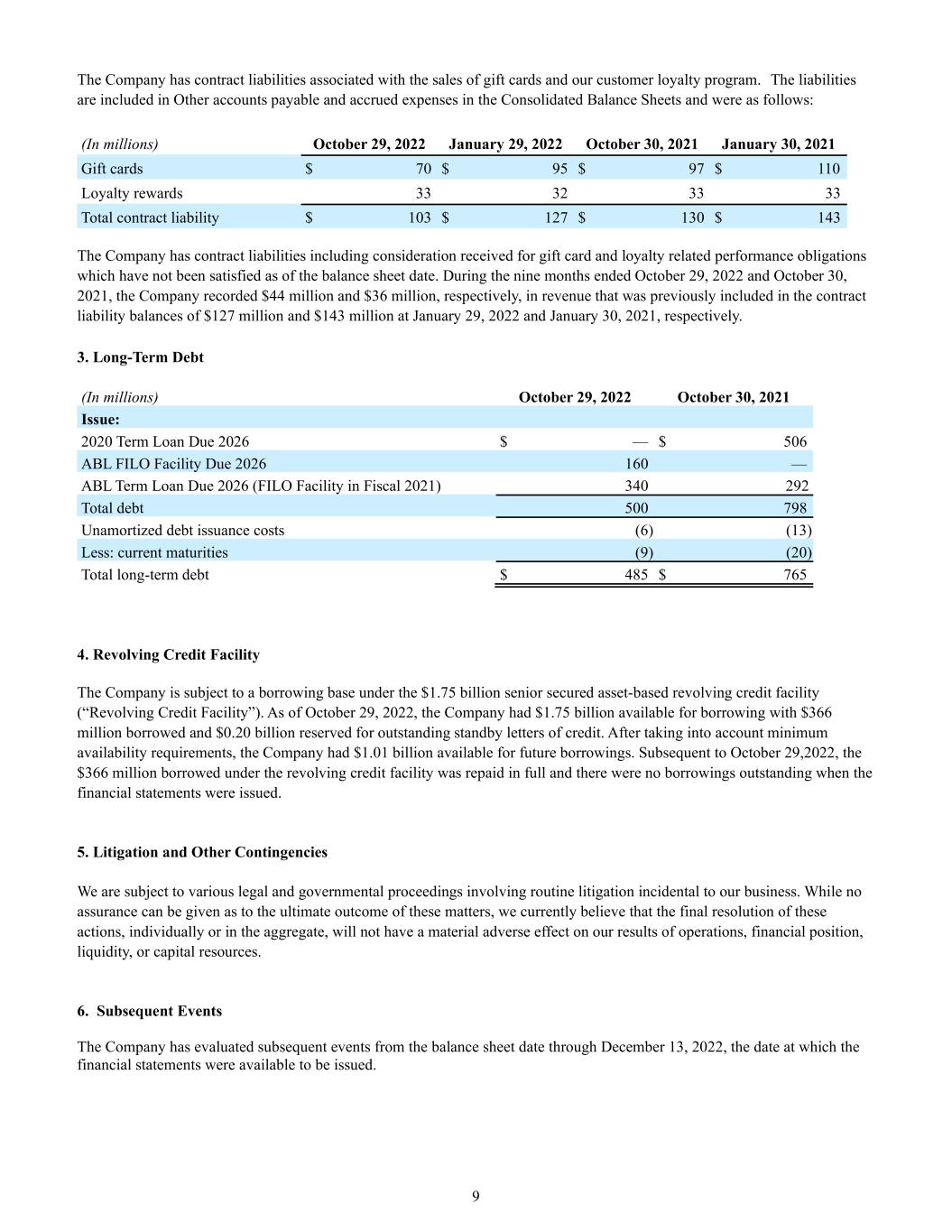

9 The Company has contract liabilities associated with the sales of gift cards and our customer loyalty program. The liabilities are included in Other accounts payable and accrued expenses in the Consolidated Balance Sheets and were as follows: (In millions) October 29, 2022 January 29, 2022 October 30, 2021 January 30, 2021 Gift cards $ 70 $ 95 $ 97 $ 110 Loyalty rewards 33 32 33 33 Total contract liability $ 103 $ 127 $ 130 $ 143 The Company has contract liabilities including consideration received for gift card and loyalty related performance obligations which have not been satisfied as of the balance sheet date. During the nine months ended October 29, 2022 and October 30, 2021, the Company recorded $44 million and $36 million, respectively, in revenue that was previously included in the contract liability balances of $127 million and $143 million at January 29, 2022 and January 30, 2021, respectively. 3. Long-Term Debt (In millions) October 29, 2022 October 30, 2021 Issue: 2020 Term Loan Due 2026 $ — $ 506 ABL FILO Facility Due 2026 160 — ABL Term Loan Due 2026 (FILO Facility in Fiscal 2021) 340 292 Total debt 500 798 Unamortized debt issuance costs (6) (13) Less: current maturities (9) (20) Total long-term debt $ 485 $ 765 4. Revolving Credit Facility The Company is subject to a borrowing base under the $1.75 billion senior secured asset-based revolving credit facility (“Revolving Credit Facility”). As of October 29, 2022, the Company had $1.75 billion available for borrowing with $366 million borrowed and $0.20 billion reserved for outstanding standby letters of credit. After taking into account minimum availability requirements, the Company had $1.01 billion available for future borrowings. Subsequent to October 29,2022, the $366 million borrowed under the revolving credit facility was repaid in full and there were no borrowings outstanding when the financial statements were issued. 5. Litigation and Other Contingencies We are subject to various legal and governmental proceedings involving routine litigation incidental to our business. While no assurance can be given as to the ultimate outcome of these matters, we currently believe that the final resolution of these actions, individually or in the aggregate, will not have a material adverse effect on our results of operations, financial position, liquidity, or capital resources. 6. Subsequent Events The Company has evaluated subsequent events from the balance sheet date through December 13, 2022, the date at which the financial statements were available to be issued.

NARRATIVE REPORT (follows this page)

Penney Intermediate Holdings LLC Narrative Report (In millions) Three Months ended October 29, 2022 Three Months ended October 30, 2021 Increase/ (Decrease) Total net sales $ 1,717 $ 1,804 $ (87) Credit income and other 86 109 (23) Total revenues 1,803 1,913 (110) Costs and expenses/(income): Cost of goods sold (exclusive of depreciation and amortization shown separately below) 1,103 1,127 (24) Selling, general and administrative 629 601 28 Depreciation and amortization 59 51 8 Real estate and other, net — (11) 11 Restructuring, impairment, store closing and other costs 10 8 2 Total costs and expenses 1,801 1,776 25 Operating income 2 137 (135) Net interest expense 18 27 (9) Income (loss) before income taxes (16) 110 (126) Income tax expense 1 4 (3) Net income (loss) $ (17) $ 106 $ (123) Other comprehensive income (loss): Currency translation adjustment (1) 1 (2) Comprehensive income (loss) $ (18) $ 107 $ (125) Summary Results of Operations for Quarter Ended October 29, 2022 Total net sales were $1.7 billion for the quarter ended October 29, 2022 and were $87 million unfavorable from prior year. Total revenues were $1.8 billion or $110 million unfavorable when compared to the prior year. Cost of goods sold as a percent of total net sales were 64.2% and 62.5% for the three months ended October 29, 2022 and October 30, 2021, respectively. Selling, general and administrative expenses were $629 million or 36.6% of total net sales compared to $601 million, or 33.3% for the prior year. Depreciation and amortization were $59 million compared to $51 million the prior year. Financial Condition and Liquidity As of October 29, 2022, the Company had $1.75 billion available for borrowing with $366 million borrowed and $0.20 billion reserved for outstanding standby letters of credit. After taking into account minimum availability requirements, the Company had $1.01 billion available for future borrowings.

Penney Intermediate Holdings LLC Narrative Report (In millions) Nine Months Ended October 29, 2022 Nine Months Ended October 30, 2021 Increase/ (Decrease) Total net sales $ 5,161 $ 5,292 $ (131) Credit income and other 276 283 (7) Total revenues 5,437 5,575 (138) Costs and expenses/(income): Cost of goods sold (exclusive of depreciation and amortization shown separately below) 3,211 3,268 (57) Selling, general and administrative 1,821 1,732 89 Depreciation and amortization 170 153 17 Real estate and other, net (6) (11) 5 Restructuring, impairment, store closing and other costs 16 31 (15) Total costs and expenses 5,212 5,173 39 Operating income 225 402 (177) Net interest expense 45 78 (33) Income (loss) before income taxes 180 324 (144) Income tax expense 4 12 (8) Net income (loss) $ 176 $ 312 $ (136) Other comprehensive income (loss): Currency translation adjustment (3) — (3) Comprehensive income (loss) $ 173 $ 312 $ (139) Summary Results of Operations for Nine Months Ended October 29, 2022 Total net sales were $5.2 billion for the nine months ended October 29, 2022 and were $131 million unfavorable from prior year. Total revenues were $5.4 billion or $138 million unfavorable when compared to the prior year. Cost of goods sold as a percent of total net sales were 62.2% and 61.7% for the nine months ended October 29, 2022 and October 30, 2021, respectively. Selling, general and administrative expenses were $1.8 billion or 35.3% of total net sales compared to $1.7 billion, or 32.7% for the prior year. Depreciation and amortization were $170 million compared to $153 million the prior year.

STATEMENT OF CONSOLIDATED ADJUSTED EBITDA (follows this page)

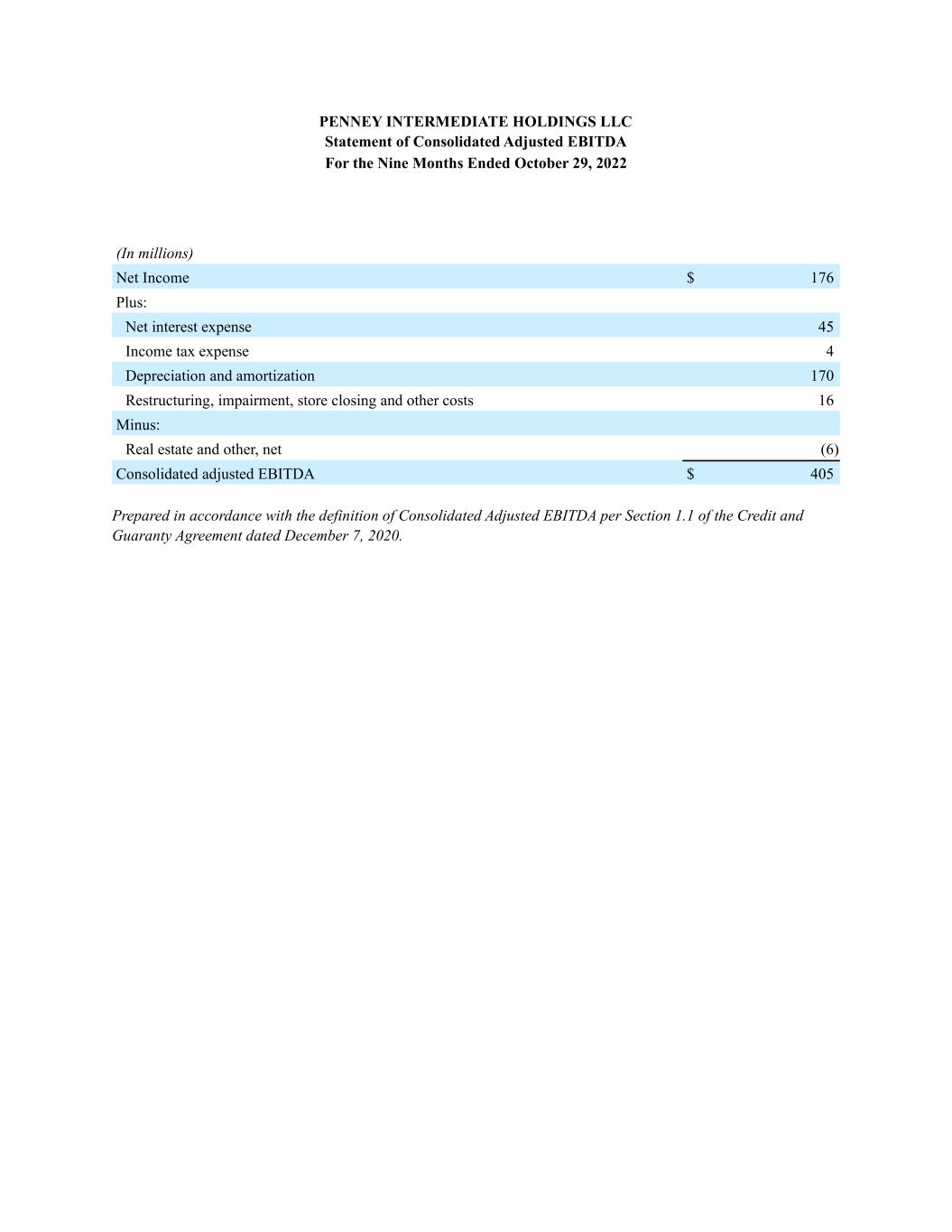

PENNEY INTERMEDIATE HOLDINGS LLC Statement of Consolidated Adjusted EBITDA For the Nine Months Ended October 29, 2022 (In millions) Net Income $ 176 Plus: Net interest expense 45 Income tax expense 4 Depreciation and amortization 170 Restructuring, impairment, store closing and other costs 16 Minus: Real estate and other, net (6) Consolidated adjusted EBITDA $ 405 Prepared in accordance with the definition of Consolidated Adjusted EBITDA per Section 1.1 of the Credit and Guaranty Agreement dated December 7, 2020.

STORE REPORTING PACKAGE (follows this page)

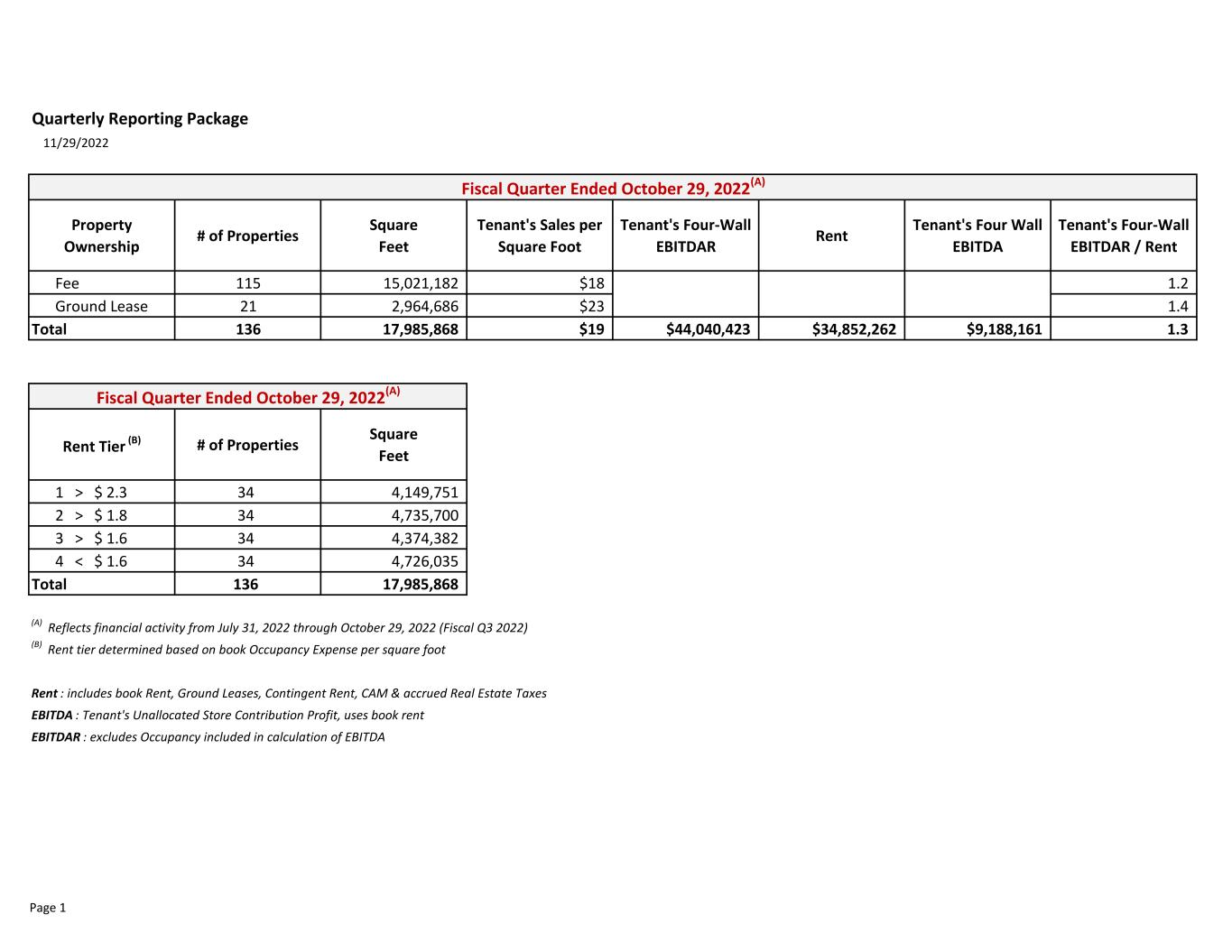

Quarterly Reporting Package 11/29/2022 Property Ownership # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Rent Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent Fee 115 15,021,182 $18 $34,125,759 $27,757,338 $6,368,421 1.2 Ground Lease 21 2,964,686 $23 $9,914,664 $7,094,924 $2,819,740 1.4 Total 136 17,985,868 $19 $44,040,423 $34,852,262 $9,188,161 1.3 Rent Tier (B) # of Properties Square Feet 1 > $ 2.3 34 4,149,751 2 > $ 1.8 34 4,735,700 3 > $ 1.6 34 4,374,382 4 < $ 1.6 34 4,726,035 Total 136 17,985,868 (A) Reflects financial activity from July 31, 2022 through October 29, 2022 (Fiscal Q3 2022) (B) Rent tier determined based on book Occupancy Expense per square foot Rent : includes book Rent, Ground Leases, Contingent Rent, CAM & accrued Real Estate Taxes EBITDA : Tenant's Unallocated Store Contribution Profit, uses book rent EBITDAR : excludes Occupancy included in calculation of EBITDA Fiscal Quarter Ended October 29, 2022(A) Fiscal Quarter Ended October 29, 2022(A) Page 1

Quarterly Reporting Package 11/29/2022 Tenant's Sales per Square Foot Tier # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Tenant's Four-Wall EBITDAR to Sales Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent > $23 34 4,033,033 $29 15.5% 1.6 > $18.6 34 4,165,036 $21 13.9% 1.4 > $15.3 34 4,843,018 $17 11.2% 1.0 < $15.3 34 4,944,781 $12 7.9% 0.7 Total 136 17,985,868 $19 $44,040,423 12.7% 9,188,161 1.3 EBITDAR / Rent Tier(B) # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Tenant's Four-Wall EBITDAR to Sales Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent > {1.0}x 88 11,018,995 $22 15.1% 1.6 < {1.0}x 48 6,966,873 $15 7.4% 0.6 Total 136 17,985,868 $19 $44,040,423 12.7% 9,188,161 1.3 (A) Reflects financial activity from July 31, 2022 through October 29, 2022 (Fiscal Q3 2022) (B) Stratifications consolidated due to insufficient store count in the top 2 stratifications. Fiscal Quarter Ended October 29, 2022(A) Fiscal Quarter Ended October 29, 2022(A) Page 2

Quarterly Reporting Package 11/29/2022 Property Ownership # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Rent Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent Fee 115 15,021,182 $83 $240,555,355 $114,760,098 $125,795,257 2.1 Ground Lease 21 2,964,686 $103 $64,997,572 $28,382,519 $36,615,053 2.3 Total 136 17,985,868 $86 $305,552,927 $143,142,617 $162,410,311 2.1 Rent Tier (A) # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Rent Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent 1 > $ 9.6 34 4,147,980 $125 $116,153,609 $48,421,954 2.4 2 > $ 7.6 34 4,703,932 $86 $82,987,095 $39,581,092 2.1 3 > $ 6.8 34 4,407,921 $81 $65,224,294 $32,000,556 2.0 4 < $ 6.8 34 4,726,035 $58 $41,187,930 $23,139,014 1.8 Total 136 17,985,868 $86 $305,552,927 $143,142,617 $162,410,311 2.1 (A) Rent tier determined based on book Occupancy Expense per square foot (B) Reflects financial activity from October 31, 2021 through October 29, 2022 (TTM October 2022) Rent : includes book Rent, Ground Leases, Contingent Rent, CAM & accrued Real Estate Taxes EBITDA : Tenant's Unallocated Store Contribution Profit, uses book rent EBITDAR : excludes Occupancy included in calculation of EBITDA Trailing 12 Months(B) Trailing 12 Months(B) Page 3

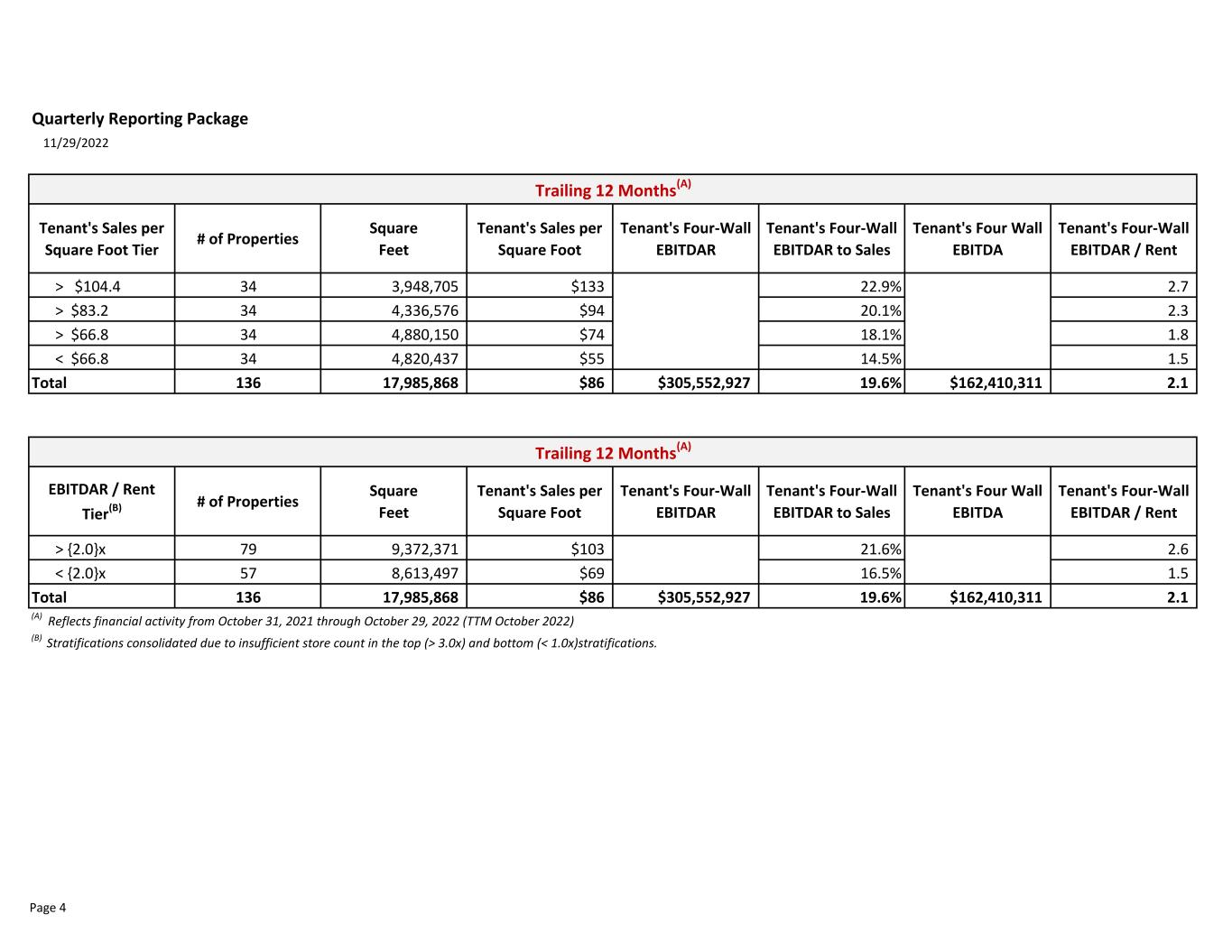

Quarterly Reporting Package 11/29/2022 Tenant's Sales per Square Foot Tier # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Tenant's Four-Wall EBITDAR to Sales Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent > $104.4 34 3,948,705 $133 22.9% 2.7 > $83.2 34 4,336,576 $94 20.1% 2.3 > $66.8 34 4,880,150 $74 18.1% 1.8 < $66.8 34 4,820,437 $55 14.5% 1.5 Total 136 17,985,868 $86 $305,552,927 19.6% $162,410,311 2.1 EBITDAR / Rent Tier(B) # of Properties Square Feet Tenant's Sales per Square Foot Tenant's Four-Wall EBITDAR Tenant's Four-Wall EBITDAR to Sales Tenant's Four Wall EBITDA Tenant's Four-Wall EBITDAR / Rent > {2.0}x 79 9,372,371 $103 21.6% 2.6 < {2.0}x 57 8,613,497 $69 16.5% 1.5 Total 136 17,985,868 $86 $305,552,927 19.6% $162,410,311 2.1 (A) Reflects financial activity from October 31, 2021 through October 29, 2022 (TTM October 2022) (B) Stratifications consolidated due to insufficient store count in the top (> 3.0x) and bottom (< 1.0x)stratifications. Trailing 12 Months(A) Trailing 12 Months(A) Page 4

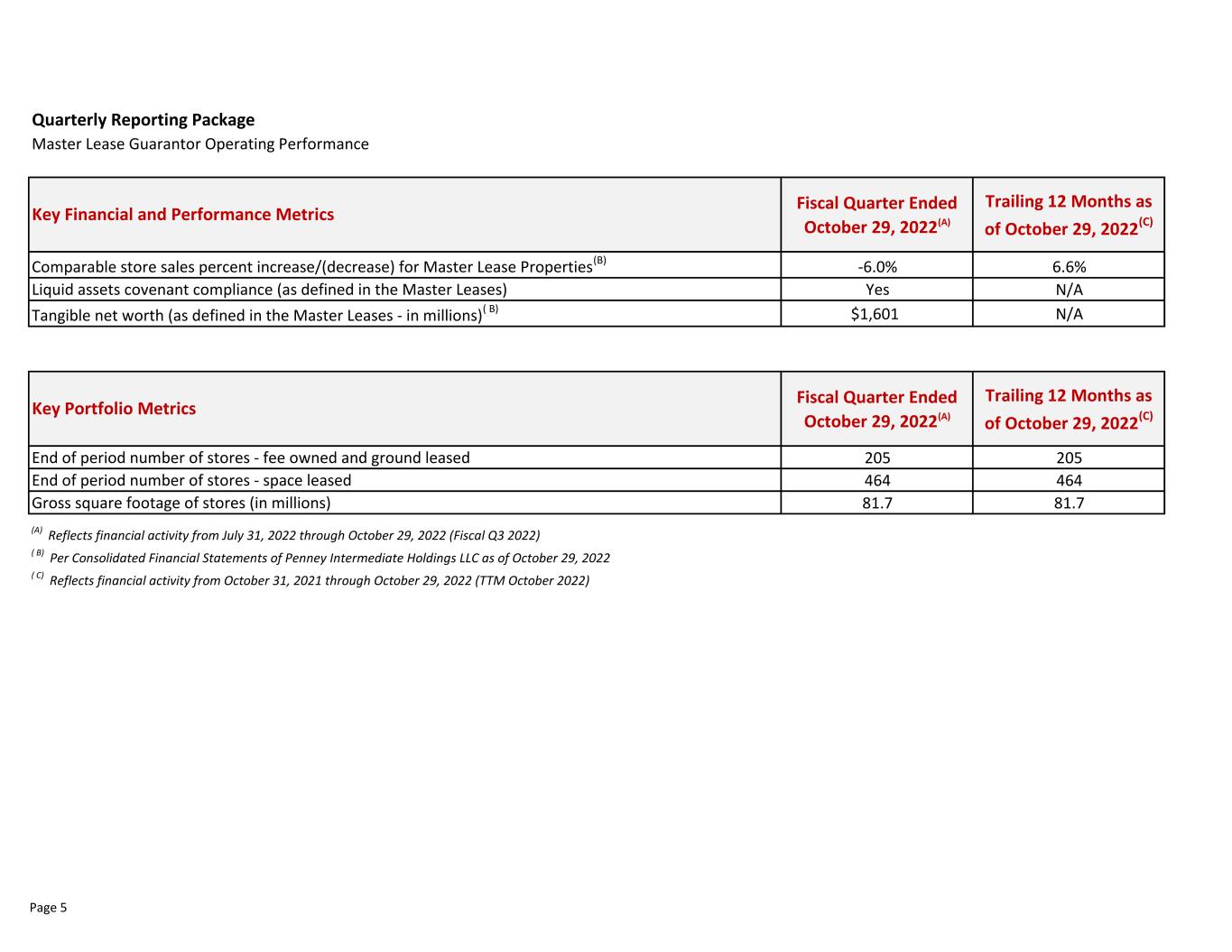

Quarterly Reporting Package Master Lease Guarantor Operating Performance Fiscal Quarter Ended October 29, 2022(A) Trailing 12 Months as of October 29, 2022(C) -6.0% 6.6% Yes N/A $1,601 N/A Fiscal Quarter Ended October 29, 2022(A) Trailing 12 Months as of October 29, 2022(C) 205 205 464 464 81.7 81.7 (A) Reflects financial activity from July 31, 2022 through October 29, 2022 (Fiscal Q3 2022) ( B) Per Consolidated Financial Statements of Penney Intermediate Holdings LLC as of October 29, 2022 ( C) Reflects financial activity from October 31, 2021 through October 29, 2022 (TTM October 2022) End of period number of stores - space leased Gross square footage of stores (in millions) Key Financial and Performance Metrics Comparable store sales percent increase/(decrease) for Master Lease Properties (B) Liquid assets covenant compliance (as defined in the Master Leases) Tangible net worth (as defined in the Master Leases - in millions)( B) Key Portfolio Metrics End of period number of stores - fee owned and ground leased Page 5